Ready to stop guessing and start growing?

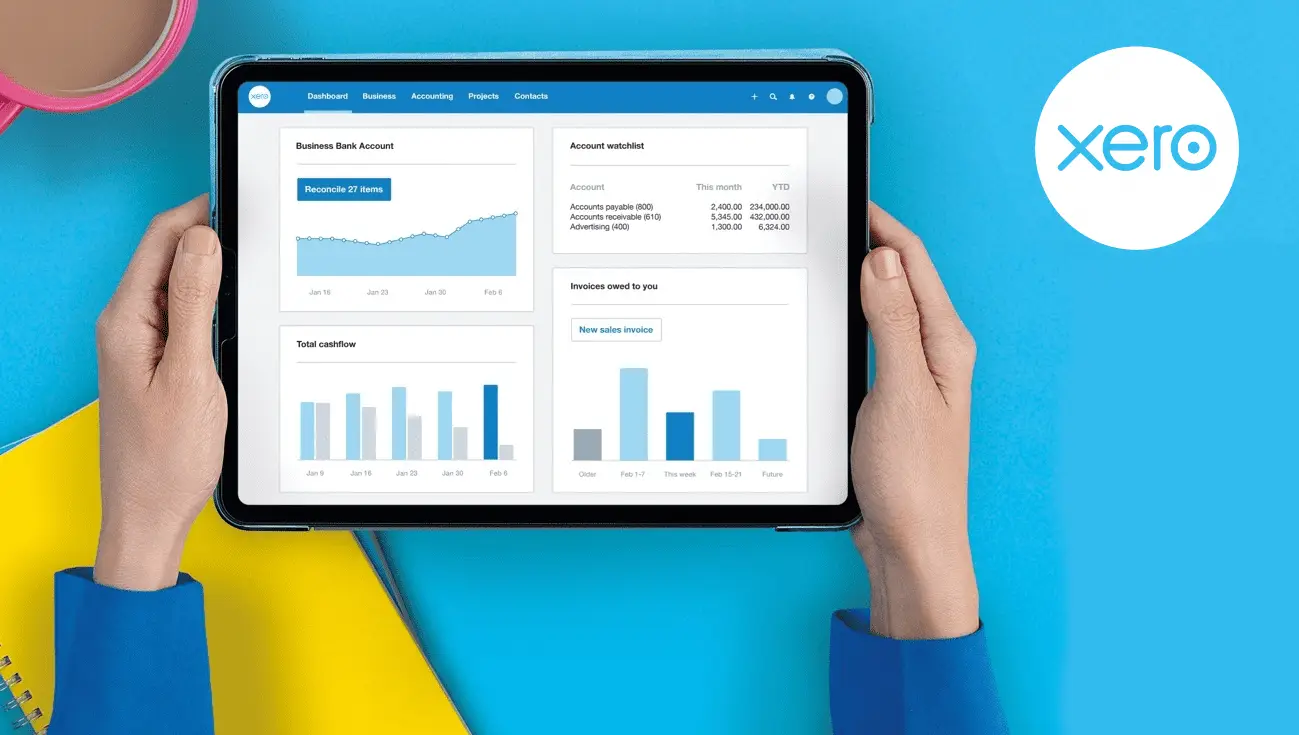

Digital tools like Xero are transforming how Kiwi businesses manage their money, giving you smarter insights, better control, and less stress. Whether you’re a not for profit accountant in Auckland or supporting a Pacific Islander business in the community, cloud solutions are streamlining how organisations operate.

Kia ora small business whānau! Cloud accounting for not for profits in NZ is helping organisations of all sizes from Pasifika business accountants to church groups and charities—make smarter financial decisions. Modern fintech like Xero brings together bookkeeping, payroll services for charities, and real-time reporting—saving time and reducing errors.

In fact, MBIE reports that 58% of growing sole traders and over 80% of businesses with 2–19 employees use non-profit accounting software. With live data at your fingertips, leaders involved in tax planning for not for profit organisations or managing community outreach finances can spot trends early and make confident, informed choices.

Xero and Cloud Accounting Benefits

- Real-time insights: Xero updates financial records instantly, transactions, invoices, and bills are synced automatically. This is a game changer for anyone offering not for profit accounting services in NZ, ensuring nothing is left to the last minute.

- Anywhere access: With cloud access, your team. Whether you’re an Auckland accountant for the Pasifika community or work with a community organisation accountant in Auckland can collaborate from anywhere. It’s a flexible option for busy groups and volunteer-run initiatives.

- Automated routines: Repetitive tasks like GST, payroll, and invoicing can be automated. This is especially useful for those managing not for profit payroll and HR in NZ, where reducing manual processes helps ensure compliance.

- Training support: Xero offers online training and webinars, with sessions tailored for those managing not for profit GST compliance in NZ. Government initiatives like Digital Boost have already helped over 60,000 Kiwi businesses, including accountants for church and community groups, to build their digital capabilities.

- Collaborative control: Everyone your bookkeeper, Pasifika financial advisor, and governance board can access the same up-to-date information. This collaborative model supports strong financial stewardship for business advisory services tailored to Pasifika organisations.

Outsourcing and Expertise

If compliance and reporting are slowing you down, outsourced bookkeeping services in NZ can ease the pressure. From regular entries to financial reporting for charities, professional support helps ensure everything aligns with New Zealand’s XRB PBE standards. Charities Services reminds nonprofits that all NZ charities must prepare financial statements under XRB PBE standards [Charities Services, 2023] – and cloud tools make meeting these obligations easier. Working with a registered charity accountant in Auckland can also help your organisation prepare accurate reports and access key benefits such as not for profit tax exemption. With reliable reporting in place, your team can shift focus to strategic goals and better serve your mission.

Xero’s research shows that SMEs adopting cloud tools can see up to 120% revenue growth and 106% higher productivity compared to non-adopters [Xero, 2022]. Whether you’re a charity tax accountant in Auckland, a Pacific Islander business accountant, or an advisor supporting not for profit organisations, Xero’s cloud platform makes it easier to stay compliant, efficient, and future-focused.